-

EURUSD Technical Analysis

The anticipated trading range for EUR/USD is between 1.16190 and 1.18100.

EUR/USD has demonstrated resilience in reclaiming the 1.17000 level; however, since breaking above nearly 1.18300 in early July, the pair’s strength has been somewhat fragile. Forex market participants have faced conflicting views, resulting in noticeable fluctuations in EUR/USD. The belief that the USD is likely to weaken over the medium term remains somewhat valid, yet last Thursday’s unexpected rise in Producer Price Index figures serves as a reminder that challenges persist.

Concerns over inflation are justified, especially given ongoing tariff-related uncertainties impacting global trade. Although market sentiment suggests a potential USD weakening, EUR/USD volatility is expected to stay lively in the upcoming week. Day traders should exercise caution and carefully assess the broader market environment. While opportunities for gains exist, overconfidence should be avoided, and setting take-profit targets for short-term gains could be a prudent strategy.

#FX #CFD #Trading #EURUSD

-

Introducing Plus500 (Forex CFD Platform)

In this passage, we are going to introduce both the goods and bads about a CFD platform - Plus 500.

Plus500 is a provider of Contracts for Difference (CFDs), delivering trading facilities on shares, forex, commodities, ETFs*, Cryptocurrencies* Options* and indices through its innovative trading platform.

The company is listed on the London Stock Exchange’s Main Market for Listed Companies and is a constituent of the FTSE 250 Index.

You will find the Plus500 platform robust and understandable. Trades can be initiated quickly and monitored closely while using built-in risk management tools to help minimise losses and/or lock in profits; however, although there’re risk management tools, please be careful that there’s still a possibility of capital losses.

You would need to make informed trading decisions and to act on those decisions is on your screen - from advanced charts to up-to-the-minute economic data.

The platform's alert notification system will notify you via Push and In-App notifications if there are material changes to the financial markets you are interested in, or when political events that may have an impact on the markets, occur.

This means you can remain informed, whether or not you are sitting in front of a computer.

Moving between Real Money trading and Demo Mode trading requires knowledge and experience, and risks are involved; you can test your skills and strategies in demo mode before doing so in a live environment.

When you trade with Plus500 you can be confident that you are trading with a regulated (Plus500CY Ltd authorized & regulated by CySEC (#250/14)) and licensed provider. Plus500SEY Ltd is authorised and regulated by the Seychelles Financial Services Authority (Licence No. SD039).

Risk warning: "Remember that CFDs are a leveraged product and can result in the loss of your entire capital. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved. Please consider our Risk Disclosure Statement and User Agreement before using our services."

DISCLAIMER:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this article, will be profitable, or suitable to your current investment portfolio.

https://www.plus500.com/zh/multiplatformdownload?clt=Web&id=137620&pl=2

-

EURUSD trading technical analysis

💶 EURUSD has slipped beneath its key support and broken through the upward trendline, hinting at a potential change in short-term market dynamics and increasing downside momentum.

In the near term, there may be a retracement back toward the former support or trendline area.

Should the pair be unable to recover and hold above this region, a further decline toward the next support level is probable.

As long as EURUSD trades below this breached area, the outlook for the short term remains negative.

-

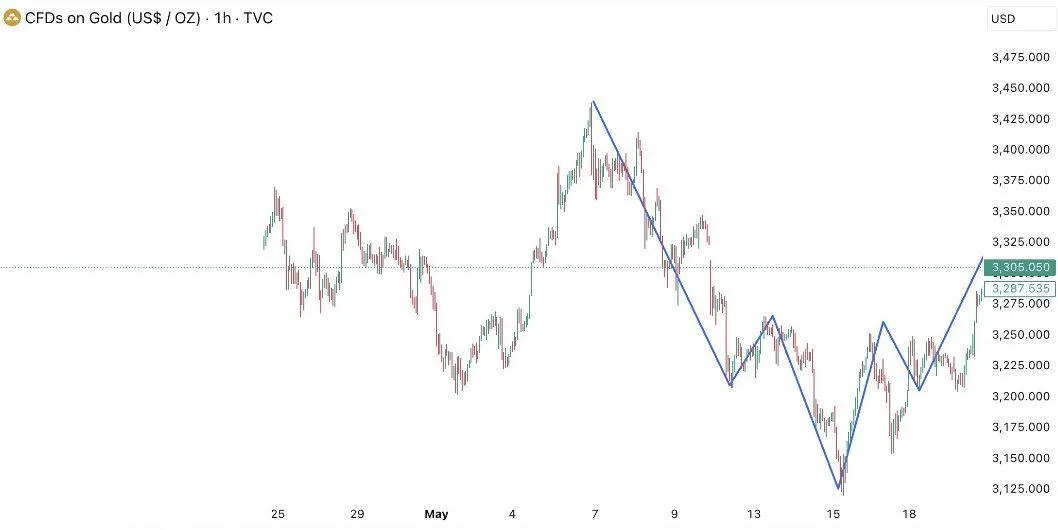

Gold technical analysis

Traders, we are closely watching XAUUSD for a potential buying setup near the 3,340 level. Gold had been in a downtrend but has now broken out of that pattern. It is currently undergoing a corrective move and is approaching the key support and resistance zone around 3,340.

-

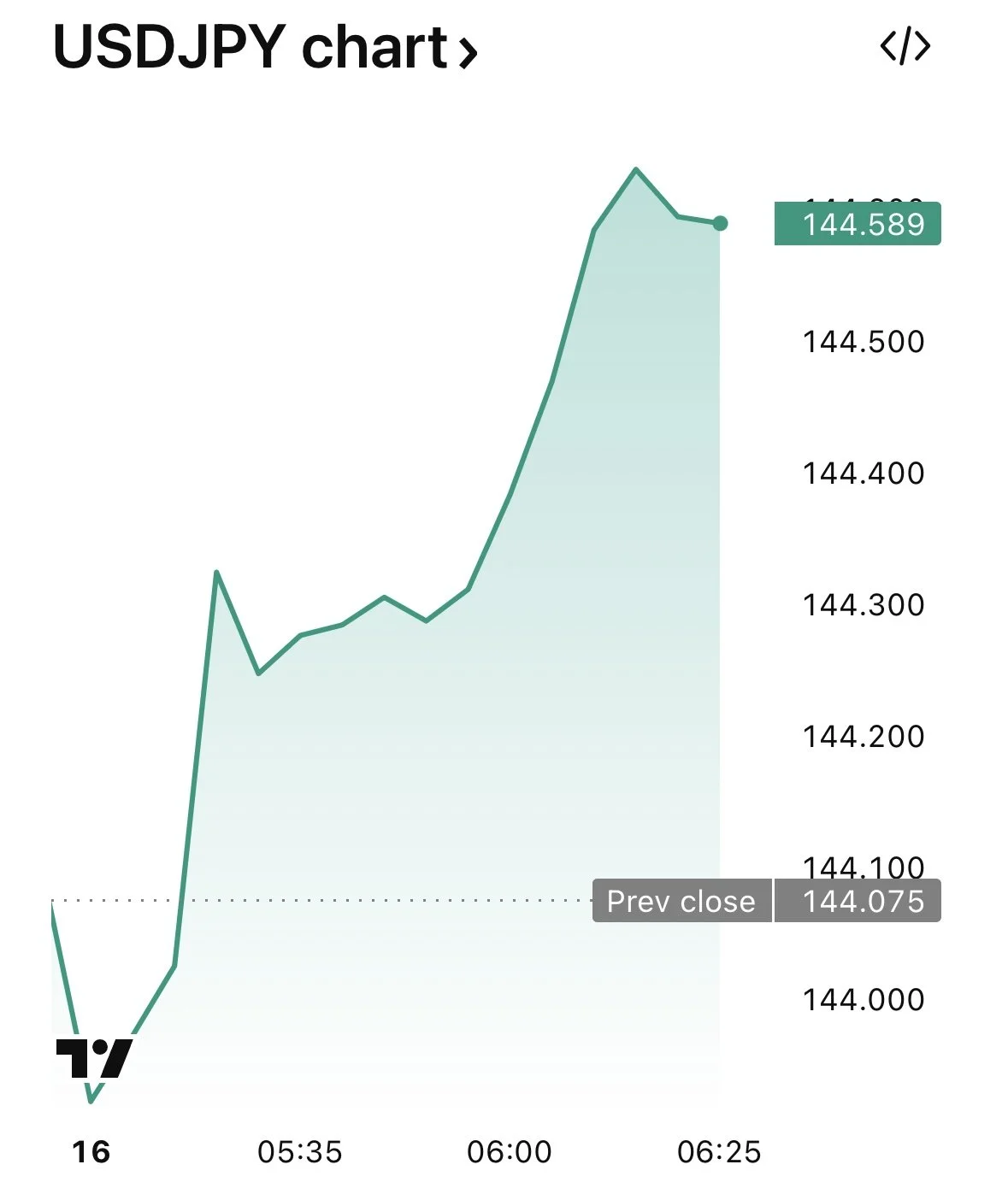

USDJPY trending

USDJPY

Our thoughts for USDJPY begins with the Yen Basket we reviewed previously. At present, the chart remains above its 2020 trend line support, but a weekly close beneath that level could signal notable yen depreciation.

Meanwhile, USDJPY needs to regain and hold above 145.4 on the higher time frames. If both these conditions are met at the same time, it may present a strong case for a USDJPY long position.

Until those criteria are fulfilled, we are staying away from USDJPY due to the volatility and lack of clear direction since May.

-

Dollar index: lowest since 2022

-

USD index

The USD was the weakest major, losing most of Wednesday’s gains but staying above December’s low.

Source: forex.com -

🤓 GBP / JPY Analysis

Since November 2024, GBP/JPY has been trending within a downward sloping channel on the daily chart. 📉

This month, the price has approached the 196.000 level near the upper boundary of this channel. Notably, there has been a double rejection pattern formed at this point. 🔄

At this stage, there’s a possibility of a price breakdown and a potential shift in the market cycle if this marks another peak. ⬇️

On the other hand, if the price pushes higher beyond this level, the current analysis would no longer hold true. 🚀

If you find this outlook convincing, consider waiting for a sell signal that aligns with your trading strategy before taking action. 📊

#forex #fx #cfd #trading #gbp #jpy

-

Gold broke consolidation

Gold (XAU) broke its consolidation support, but with the whole market in the correction phase.

#xau #usd #forex #fx cfd #trading

-

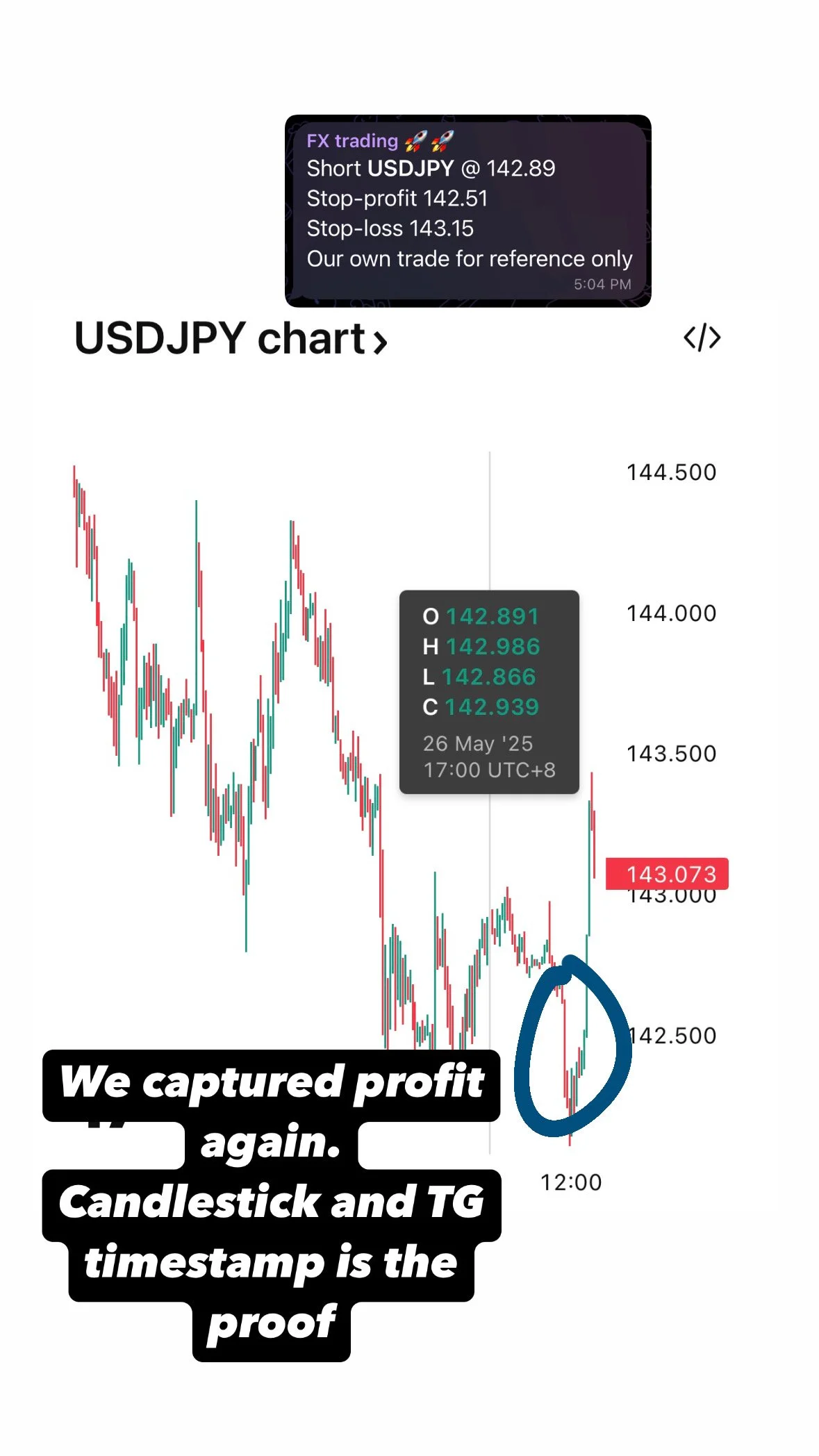

USDJPY trade result

We captured profit again. Candlestick and TG timestamp is the proof

#fx #forex #cfd #trading #usd #jpy

-

We took profit from EURJPY !

Crazy 🤯

Highest only 162.752

Before BIG reverse hitting profit

#forex #fx #cfd #trading

-

AUDUSD short

🚀 Market was flying up due to American election and tariffs, but there’s a possibility that the market will drop as quickly as it went up. Let’s wait and see.

#aud #usd #forex #fx #trading #cfd

-

XAU USD 1-hr tech analysis confirmed correct

2 days ago, we shared our plan of a buy trade on XAUUSD (Gold) from 3290 with a target price at 3400. Yesterday, gold has climbed to the 3,344 level, gaining 500 PIPs, and we are awaiting the full completion of all targets at 3,400.

-

EUR/GBP - Strong Support at the Blue Box

In the latest EUR/GBP chart analysis, we identified a significant drop exceeding 200 pips from the recent high. The price has now stabilized within the blue-highlighted support zone, an area where prior retracements attracted buyers and genuine value was established.

Therefore, if the price manages to break above the nearby resistance marked in red on lower time frame charts—and this move is supported by sustained momentum rather than a brief surge—taking a long position would be justified. Such a breakout would indicate that buying interest has surpassed selling pressure, signaling a disciplined and confirmable resumption of the upward trend.

Our approach has always been grounded in data-driven analysis rather than speculation or emotion. Each level is selected through rigorous examination of price action and empirical evidence, resulting in consistently reliable outcomes. To maintain prudent risk management, we seek confirmation of these critical levels before deploying capital, a strategy that has proven effective for us and should benefit our followers as well.

-

FX Market Update

Investors worry about Trump's tax bill and GOP disagreements, pushing the US dollar down for the third day.

US Dollar Index: down 0.5% to 99.6

EUR/USD: up to 1.133

USD/JPY: down to 143.6

GBP/USD: up to 1.341

USD/CAD: down to 1.386

USD/CHF: down to 0.824

AUD/USD: up to 0.643

#forex #fx #cfd #trading -

FX Calendar (May 18 - 24, 2025)

Important events that impact FX trading for the week!

Highlights:RBA press conf, Canada CPI, UK CPI, US employment claims, US new home sales

There are more events affecting the market. Here we choose those with strong importance on G10 currencies. Any questions about FX trading, feel free to contact us.

Source: Forex Factory

-

🤩 Gold’s Make-or-Break Level: $3167 is Crucial

📊 Gold Spot is currently at a pivotal turning point. For those tracking the charts closely, the key pressure zone is clearly around $3167.

Technically, this price level has served as a medium-term support, helping to absorb recent pullbacks and giving bullish traders a crucial foothold 🐂. However, that support is weakening, and a decisive break below this threshold could trigger a notably bearish move.

👀 Why the $3167 Level Is Crucial

Examining the recent price action, every rally and bullish effort over the past week has relied heavily on the $3167 mark. This isn’t an arbitrary figure; it’s where buyers have consistently defended the market.

At present, though, the strength of these rebounds is diminishing. Trading volume is dropping, and the price is hovering just above this support-a pattern that often precedes a breakdown ⚠️.

Should gold fall below $3167 and close under it, expect downward momentum to pick up rapidly. Momentum-driven traders are likely to jump in, potentially pushing prices down toward the $3075 to $3052 range, where stronger buying interest has been observed.

👀 Key Signals to Monitor

A clear hourly candle closing beneath $3167, preferably accompanied by increased volume.

A potential retest of the $3167 level after a breakdown, which could present an ideal short-selling opportunity.

The Bearish Outlook

If the support fails, my initial target would be $3052 for a possible rebound. This level has historically seen accumulation and coincides with a cluster of lows from late April. Additionally, it represents an important psychological barrier and could serve as a point for intraday reversals.

-

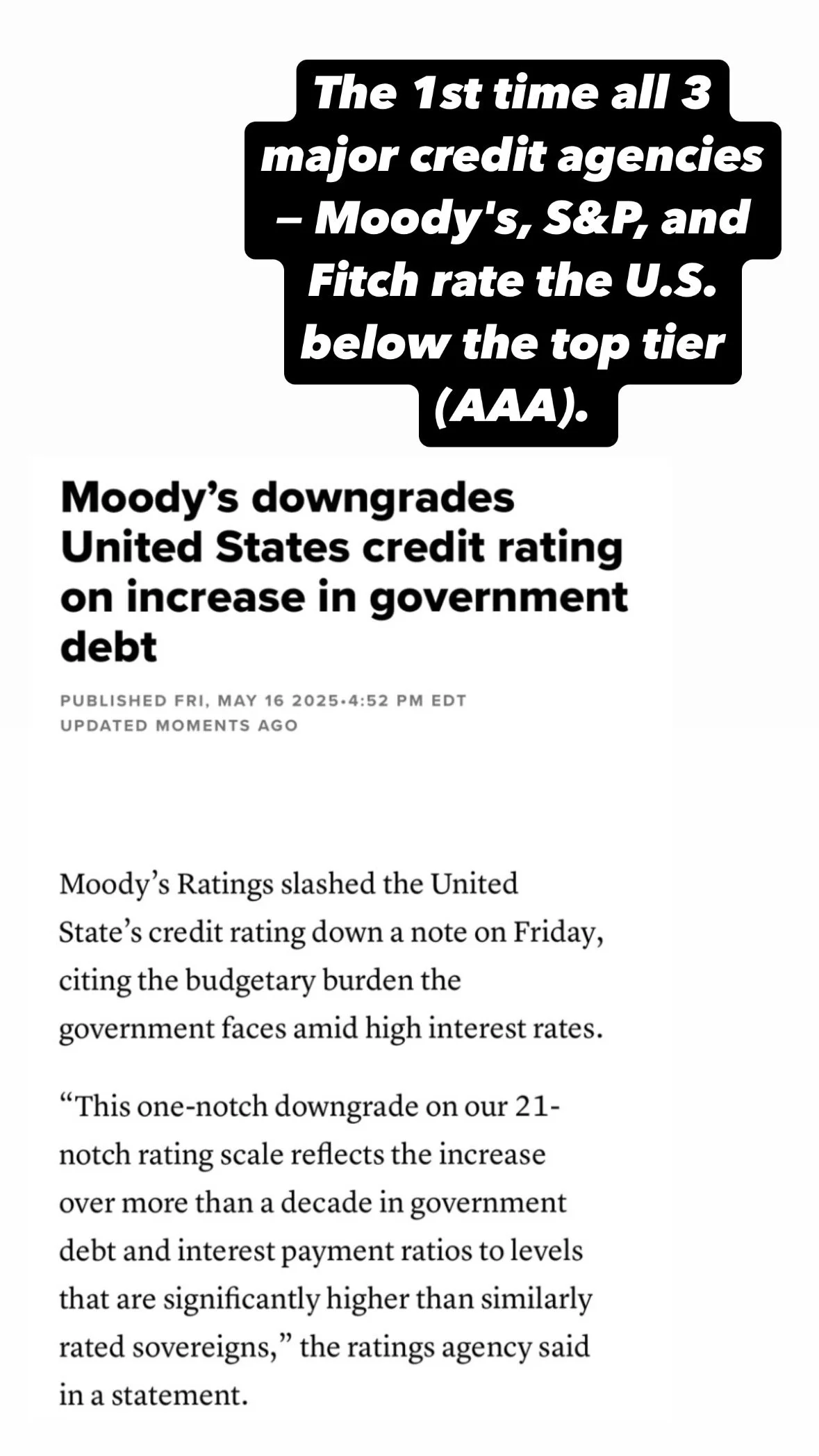

Moody's downgrades United States

Moody's downgrades United States. The 1st time all 3 major credit agencies - Moody’s, S&P, Fitch rate the U.S. below the top tier (AAA).

Key effects we think on the Downgrade (& fiscal risks) that may appear:

> USD weakness

> FX volatility higher

> JPY CHF (safe-haven) rises

> EUR gain as investors diversify

> Long-term pressure on USD

Share to your friends!

-

Forex Trading 101 (Part 2)

In part 1, we have learnt some basic terms in forex trading. Now, let’s continue to study more in this passage.

Analysing the Market

Forex traders primarily use two main methods to try and predict currency price movements:

1. Technical Analysis - Studying historical price charts and patterns to forecast future price changes.

2. Fundamental Analysis - Examining economic, political, and social factors that influence exchange rates.

By using a combination of these analytical techniques, Forex traders aim to identify profitable trading opportunities in the constantly fluctuating currency markets.

Staying Safe in Forex

When it comes to Forex trading, risk management is absolutely essential for success. Setting up stop-loss orders can help limit your potential losses, and using the right position sizing will protect your overall capital.

Choosing the Right Broker

Picking the right Forex broker is also crucial. Look for one with a solid reputation and legitimate regulation from governments, competitive pricing (low spreads), and a user-friendly trading platform.

In Conclusion

Forex can be enjoyable, but you have to approach it the right way. Remember that losses are a part of trading, you are taking risks whenever trading, and no strategy is 100% foolproof. It's a journey of learning from your mistakes and adapting to the constantly changing market conditions. If you're intrigued by Forex, take the time to build a solid foundation of knowledge and practical experience. With dedication and the right mindset, you can successfully navigate the exciting world of currency trading. Good luck!

-

Forex Trading 101 (Part 1)

The World of Forex Trading

Have you ever wondered about the Forex market? You're not alone. Forex, short for foreign exchange, is actually the largest financial market in the world. In fact, over $6 trillion worth of currency trades happen each day on the Forex market. What makes Forex trading unique is that it operates around the clock, allowing you to buy and sell currencies from anywhere on the globe. But before you jump in, it's important to understand the basics.

What is Forex Trading?

At its core, Forex trading is about exchanging one currency for another, with the goal of making a profit as the exchange rates fluctuate. For example, if you think the euro is going to increase in value compared to the US dollar, you can buy euros using dollars. Then, when the rate is better, you can sell the euros back for a higher dollar amount.

Major players in the forex market

1. Retail Traders: Individuals trading Forex through brokers.

2. Central Banks: They affect exchange rates by adjusting central bank policy rates and managing currency reserves.

3. Banks: Major financial institutions trading Forex.

4. Corporations: Corps usually using Forex to hedge against currency risk stemmed from international trades.

5. Hedge Funds: Large trading funds that can long & short currencies for profit.

Currency Pairs in Forex

When you trade in the Forex market, you always buy and sell currencies in pairs. The first currency is called the "base" currency, and the second is the "quote" currency. For example, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency.

Leverage and Margin

Many Forex traders use something called "leverage" to amplify their potential profits. Leverage basically lets you control a large amount of money with a small initial investment. However, leverage is a double-edged sword - it can also magnify your losses if the trade goes against you. That's why managing your leverage and margin is so important for managing your risk in Forex.

-

Introducing Capital.com

In this passage, we are going to introduce capital.com

Founded in 2016, Capital.com is a global CFD broker with Limassol, Cyprus as headquarters. The provider enables its 630,000+ clients worldwide to hone their trading skills with new technology and informed educational resources, all designed specifically for the high-speed, intricate, and dynamic competitive modern markets.

The platform provides charts, drawing tools, and 100+ indicators to enhance their analysis skills. With leveraged trading, investors can control larger positions with low margins, although traders should understand that leverage is risky as it amplifies both profits and losses.

Capital.com keeps a fee structure that is in tandem with its commitment to a user-centred experience, offering traders a clear breakdown of fees for insightful decisions. Trading with Capital.com involves zero commissions (other fees apply), competitive spreads, and fee transparency. Trade execution costs are embedded within the spread, representing the buy-sell price difference. Capital.com also charges a fee for guaranteed stop-loss orders (not all stop-losses are guaranteed), a currency conversion fee, and a fee for overnight funding related to positions held overnight. For detailed fee information, refer to the charges and fees section on Capital.com’s website.

Choosing a reliable broker is of extreme importance, and Capital.com takes this importance seriously. The company prioritizes regulatory compliance and deploys strong measures to ensure the security of traders’ funds and personal information.

Regulation: Capital.com is a regulated broker, sticking to industry guidelines and standards. It is authorized and regulated by well-known authorities, including Australia’s ASIC, Cyprus’s CySEC, the UK’s FCA, The Bahamas’ SCB and the UAE’s SCA. This keeps the broker operating within defined frameworks and offers investors protection against malicious malpractices.

Client Fund Security: Capital.com’s commitment to client fund security is obvious through the use of segregated accounts. Traders’ funds are kept separate from broker’s operational funds, lowering the risk of misappropriation / commingling.

Risk Warning: 70.04%-83.51% of retail investor accounts lose money when trading CFDs with Capital.com Group. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

DISCLAIMER:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this article, will be profitable, or suitable to your current investment portfolio.

-

Introducing Interactive Brokers

In this passage, we are going to introduce Interactive Brokers (“IBKR”).

IBKR has clients in over 200 countries and territories trade stocks, options, futures, currencies, bonds, funds and more on 150 global markets from a single unified platform with available products worldwide. It supports trading assets in 27 currencies. It allows you to scan the world for investment opportunities with the World Map Screener and the World Data Screener.

If an exchange provides a rebate, they pass some or all of the savings directly back to the investors. As of Aug 2nd 2024, the platform allows an earning of interest rates of up to USD 4.83% on instantly available cash.

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Usually a strong capital position, conservative balance sheet and automated risk controls are essential to protect clients from large trading losses. As of Aug 2nd 2024, IBKR is listed on NASDAQ exchange, has 10.4B excess regulatory capital and 2.92M client accounts. It is also awarded as the best online broker last year by Barrons.

Although IBKR is a worldwide name and has gained close to 3M client accounts, we believe that there are many online brokers you could choose from. You should take your time and shop around; compare between different brokers especially about the legitimacy, reputation and trustworthiness before making a decision.

DISCLAIMER:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this article, will be profitable, or suitable to your current investment portfolio.

-

Online Brokerage Comparison 2024

Here’s a good and bad comparison of three of the brokers, pay attention :)

1. Saxo Investment Account

3 Facts about Saxo Markets : 1)Saxo's parent company is Saxo Bank from Denmark, which holds over 1m clients worldwide 2) Saxo has competitive and highly transparent fees, with minimum to none inactivity fees, platform fees or custody fees 3) Access over 125 exchanges worldwide including core and emerging markets such as US, Japan & Europe. There are over 71,000+ instruments at industry-leading prices across stocks, FX, bonds and commodities, etc. However, please beware derivatives are high-risk instruments and Saxo Markets has a higher risk inclination amongst brokers. Please be careful when measuring your risk appetite before making decisions.

2. uSMART Securities Account

3 Facts about uSMART Securities : 1)AI “Smart-Strategy” system supported by Big Data, providing smart screening, rating, ranking and notification 2)Provide monthly investment plans, conditional orders and 24-hour FX swaps on trading days 3)IPO subscription margin interest rate at 1.6%. However, the market penetration rate of uSMART is relatively low with less user feedbacks.

3. Futu Securities Account

3 Facts about Futu Securities Account: 1)Futu Securities supports comprehensive investment tools, self-developed intelligent tracking function to navigate the market stocks 2)Trade mechanics: 0.0037s to place an order 3)Low transaction cost

For more detailed information such as the complete terms & conditions, please kindly refer to their websites.

DISCLAIMER:

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this article, will be profitable, or suitable to your current investment portfolio.